Insure Your Property

What is flood insurance?

Flood insurance covers direct losses to a building and its contents caused by flooding, including local drainage problems. Policies are available through the Federal Emergency Management Agency (FEMA)’s National Flood Insurance Program (NFIP) to participating communities, as well as through private carriers.

Who needs flood insurance?

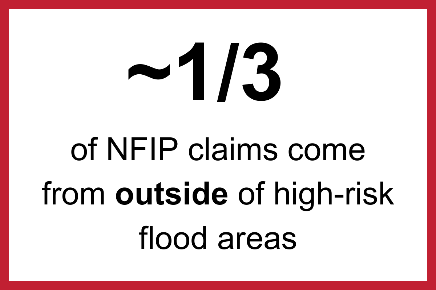

Everyone. Flooding can happen anytime, anywhere. Plus, most homeowners insurance policies do not cover flood damage.

That means all property owners can benefit from flood insurance no matter their location. Some high-risk properties, however, are required to have flood insurance.

Check your property’s risk with Mesa County’s GIS viewer.

How does it work?

Mesa County participates in the Federal Emergency Management Agency (FEMA)’s National Flood Insurance Program (NFIP), which makes federally backed flood insurance available for all eligible buildings regardless of whether they are in a floodplain (any area susceptible to flooding).

FEMA sets flood insurance rates based on decades of mapping data, including distance from flood source, type and frequency of flooding, and cost to rebuild.

A jurisdiction’s eligibility to participate in the NFIP is based on its adoption and enforcement of floodplain management regulations to reduce flood damage. Based on the County’s flood mitigation, protection, and outreach efforts, Mesa County residents receive a 15% discount on their federal flood insurance premiums as a result of our participation in the NFIP Community Rating System (CRS).

Policies take about 30 days to become active. Don’t wait for a flood warning before you consider flood insurance!

To learn more about the NFIP and the CRS, visit the FEMA Community Rating System web page.